April 2012

Motorcycle Market Trends in Japan: Summary of Results of JAMA's Fiscal 2011 Survey

The Japan Automobile Manufacturers Association is pleased to release the results of the survey it conducted in fiscal year 2011 (ending March 31, 2012) on motorcycle market trends in Japan. Primarily targeting new-model purchasers, JAMA conducts this survey in odd-numbered years in order to track changes in Japan’s continuously evolving motorcycle market.

The latest survey drew 5,150 responses, and adjunct surveys were carried out simultaneously to clarify the situation behind the prolonged decline in demand that has come to characterize Japan’s motorcycle market.

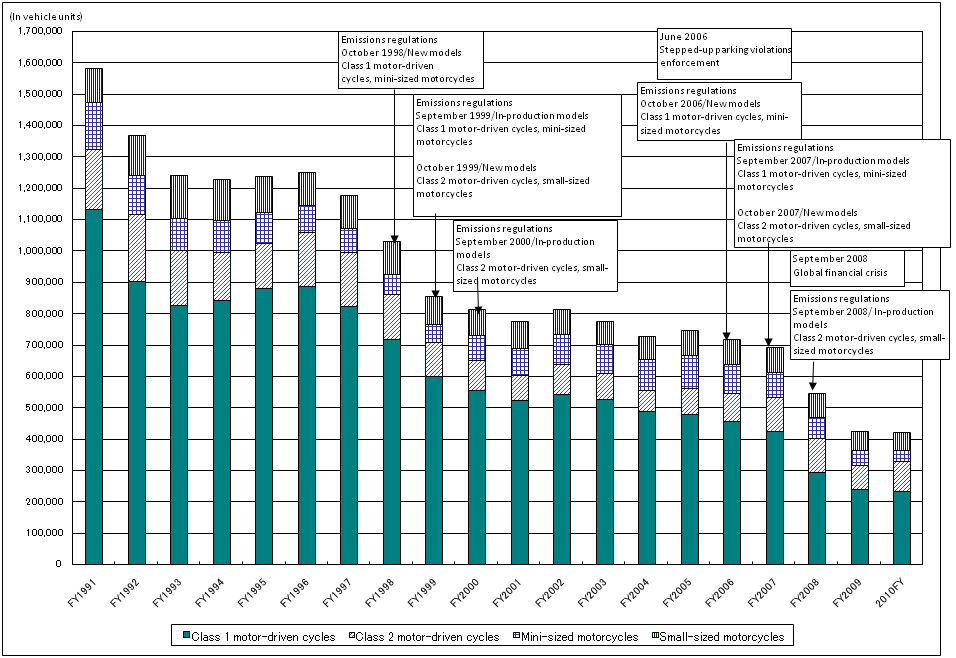

Trends in Motorcycle Demand in Japan, Fiscal 1991-2010

Click to enlarge

1. Main Survey (Purchasers of New-Model Motorcycles): Principal Findings

- Ownership declined among users in their 30s or younger, but increased among users in their 50s or older, underscoring the continued rise in the average age of motorcycle users.

- Replacement demand accounted for 59% of all new-model purchases, up from 57% in the 2009 survey. First-time purchases accounted for 15% of the total, not significantly different from the previous survey’s figure but underscoring a sustained decline in first-time motorcycle purchases.

- Over 70% of owners in Tokyo (i.e., its main 23 wards) reported experiencing difficulties in finding parking space for their motorcycles.

- Respondents expressing the desire to continue riding motorcycles in the future totalled 87%, down from the 92% recorded in 2009.

2. Adjunct “Special Topics” Surveys

1) On Reasons for the Decline in Motorcycle Demand: Principal Findings

Responses by engine capacity:

- Class 1 motor-driven cycles (50cc & under): “No further need for use (commuting to work/school, etc.),” “Retired from work/Quit job,” “Started working/Changed jobs,” “Purchased power-assisted bicycle,” “More convenient to take train or bus.”

- Class 2 motor-driven cycles (51-125cc): “Difficult to park at destinations,” “Difficult to park at home,” “Motorcycle was stolen,” “Cited for motorcycle parking violations,” “Retired from work/Quit job.”

- Mini-sized motorcycles (126-250cc): “Difficult to park at home,” “Lost confidence in own strength and stamina,” “Fewer friends and acquaintances to ride with,” “Less time for motorcycling due to other interests,” “Difficult to park at destinations.”

- Small-sized motorcycles (251-400cc): “Work schedule leaves no time for motorcycling,” “Daily activities leave no time for motorcycling,” “Less time for motorcycling due to other interests,” “Fewer friends and acquaintances to ride with,” “Difficult to park at destinations.”

- Small-sized motorcycles (401cc-): “Had children,” “Motorcycle upkeep costs,” “Work schedule leaves no time for motorcycling,” “Daily activities leave no time for motorcycling,” “Family members/others increasingly opposed to my motorcycle use.”

Responses by age group:

- Teens/20s: “Started working/Changed jobs,” “Purchased automobile,” “Purchased mini-vehicle,” “Spending on travel instead,” “Spending on audio-visual equipment instead.”

- 30s: “Got married,” “Moved,” “Purchased real estate,” “Motorcycle upkeep costs,” “Rent payments on residence/land.”

- 40s: “Work schedule leaves no time for motorcycling,” “Daily activities leave no time for motorcycling,” “Motorcycle upkeep costs,” “Education costs (rider/family members),” “Difficult to park at destinations.”

- 50s: “Lost confidence in own strength and stamina,” “Purchased power-assisted bicycle,” “Retired from work/Quit job.”

2) On Secondhand-Motorcycle Purchasers: Principal Findings

Note: References to new-model purchasers are based on information obtained from the main survey.

- In the Class 1 and Class 2 motor-driven cycle categories, the percentage of men purchasing secondhand models was higher than the percentage of men purchasing new models.

- In all motorcycle categories, the percentage of persons in their 30s and 40s purchasing secondhand models was higher than the percentage in their 30s and 40s purchasing new models.

- The percentage of secondhand-model repeat purchasers was higher than the percentage of new-model repeat purchasers.

- Reasons for purchasing secondhand models: “The model and engine capacity I wanted had to be within budget,” “Don’t have the financial leeway to purchase a new model,” “Secondhand models can be handled with less concern [for damage, etc.] than new models.”

3) On New-Model Users’ Perceptions of Motorcycles: Principal Findings

- A large percentage of women respondents viewed motorcycles as a “Means of transport” and “Lifestyle commodity,” while a significant percentage of male respondents considered them a “Hobby item.”

- A high percentage of users in their teens viewed motorcycles as a “Means of transport,” while a high percentage of users in their 60s or older saw them as a “Lifestyle commodity.”

Complete survey results are posted online, in Japanese only, at www.jama.or.jp/.