April 2014

Motorcycle Market Trends in Japan: Summary of Results of JAMA Fiscal 2013 Survey

The Japan Automobile Manufacturers Association is pleased to release the results of the survey it conducted in fiscal year 2013 (ending March 31, 2014) on motorcycle market trends in Japan. This survey, whose primary targets are new-model purchasers, is conducted by JAMA in odd-numbered years to track changes in Japan’s continuously evolving motorcycle market. Along with this survey, meanwhile, adjunct “special topics” surveys were also conducted to monitor specific related issues.

The main objective of the “special topics” surveys this time was to clarify the realities behind the prolonged decline in demand that has come to characterize Japan’s motorcycle market, in order to determine what needs to be done to counter this trend. Issues these surveys examined included: (1) Shifting perceptions and motivations in regard to motorcycle use; (2) The extent of awareness of, and purchasing projections stemming from, the adoption of a range of internationally harmonized standards; and (3) Projected market trends prior to two scheduled hikes in Japan’s national consumption tax rate, first from 5% to 8%, and subsequently to 10%.

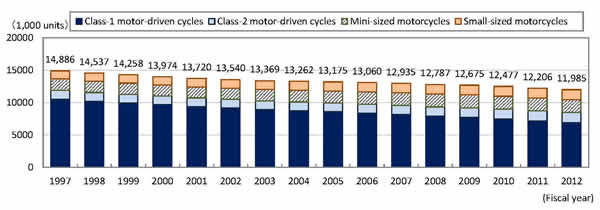

Trends in Motorcycle Demand in Japan

Left axis: x 1,000 units

Right axis: Fiscal year

Bar color code (from bottom to top):

- Class-1 motor-driven cycles

- Class-2 motor-driven cycles

- Mini-sized motorcycles

- Small-sized motorcycles

Sources: Japan Automobile Manufacturers Association; Japan Mini Vehicles Association

Trends in Motorcycle Ownership in Japan

Left axis: x 1,000 units

Right axis: Fiscal year

Bar color code (from bottom to top):

- Class-1 motor-driven cycles

- Class-2 motor-driven cycles

- Mini-sized motorcycles

- Small-sized motorcycles

Source: Japan’s Ministry of Land, Infrastructure, Transport and Tourism

I. Main Survey: Principal Findings

Focusing on purchasers of new-model motorcycles, the survey revealed the following:

- Ownership has continued to decline steadily among young men in their teens, 20s and 30s. Ownership by women has levelled off since fiscal 2009, although among women respondents in their 50s or older, the ownership rate surpassed 60%. Meanwhile, the trend of rising ownership of scooters and business-use lightweight motorcycles under 50cc in engine capacity among users in their 50s or older has grown more pronounced.

- Replacement demand accounted for 61% of all new-model purchases, up 2% from the last survey. Unchanged from the previous survey, first-time purchases stood at 15% of the total, underscoring the sustained stagnation in these purchases.

- The average period of motorcycle ownership prior to its replacement with a new purchase was 6.6 years, up from the previous survey’s 6.1 years and confirming the trend towards longer ownership, which was particularly marked for scooters 50cc and under in engine capacity.

- Respondents expressing the desire to continue riding motorcycles in the future totalled 88%, up slightly from the 87% indicated in the previous survey.

II. Adjunct “Special Topics” Surveys: Principal Findings

1. Shifting perceptions and motivations in regard to motorcycle use

- Launched in the 1970s in Aichi Prefecture and later expanding nationwide amid rising numbers of motorcycle accidents, the “3 Don’ts Movement” was a campaign whose objective was to discourage high school students from acquiring motorcycle licenses and from purchasing and riding motorcycles (the campaign’s trio of slogans were: “Don’t become licensed to operate a motorcycle, “Don’t buy a motorcycle,” and “Don’t ride a motorcycle.”)

- Few members of the general public, including the parents of junior and senior high school students, are today aware of the shift of the movement’s focus away from prohibition to the positive promotion of proper motorcycle riding practices.

- On the contrary, many adults who were the targets of the 3 Don’ts Movement at its peak continue to view motorcycle riding as dangerous. The perception that motorcycles and motorcycle riding are unsafe being particularly prevalent among women with children of school age, there is in fact a fairly widespread tendency among them to favor outright bans on motorcycle use for youngsters of school age, even though motorcycle licenses are obtainable from the age of sixteen.

- Against that backdrop, the purpose of this particular survey was to determine the potential for future increases in the number of motorcycle users in Japan by examining perceptions and motivations regarding motorcycle use among motorcycle license holders who had never actually owned a motorcycle. Of those respondents, 65% affirmed their desire to “Ride motorcycles if the occasion presents itself,” from which it may be inferred that they had not ridden motorcycles until now as a result of economic factors and a lack of motivation to make a motorcycle purchase. However, those respondents also indicated a readiness to use a motorcycle at the earliest opportunity, which suggests that there are in fact lower hurdles to a potential motorcycle purchase among this segment than among persons who are not yet motorcycle license holders.

2. Extent of awareness of, and purchasing projections stemming from, the adoption of internationally harmonized standards

- This survey targeted first-time motorcycle purchasers, and 70% of the respondents indicated “No knowledge whatsoever” of internationally harmonized standards in the manufacture of motorcycles.

- Expectations expressed in regard to the adoption of internationally harmonized standards included expanded choices on the Japanese market for the purchase of models with larger engine capacity as well as on-road and off-road models, and the ability to “Purchase models sold overseas” and “Purchase models from overseas manufacturers,” among others.

- A similar trend was demonstrated among respondents who were secondhand motorcycle owners or first-time motorcycle owners who had owned their motorcycle for at least three years, underscoring high expectations among secondhand model owners for “Lower prices.”

3. Projected market trends prior to two scheduled hikes in Japan’s consumption tax (from 5% to 8% in April 2014, to 10% in October 2015)

- In response to questions concerning future motorcycle purchases, 11% of secondhand model owners and 15% of owners of new models (owned for at least three years) responded that they were considering replacement purchases by the end of March 2014 (in advance of the first scheduled increase in the consumption tax from 5% to 8%). In addition, 20% of secondhand model owners and 26% of owners of new models (owned for at least three years) indicated they were considering replacement purchases by the end of September 2015 (in advance of the second scheduled consumption tax hike, from 8% to 10%).

- However, when specifically queried about their purchasing intentions in relation to the consumption tax hikes, some 20% of both secondhand model owners and owners of new models (owned for at least three years) indicated their intention to “Accelerate new-model or replacement purchases,” while approximately 50% responded that the scheduled tax hikes would have “No impact.” It can therefore be inferred that purchases by the latter category of respondents will constitute “Normal replacement purchases” and not so-called last-minute demand.

Complete survey results are posted online, in Japanese only, at http://www.jama.or.jp/lib/invest_analysis/two-wheeled.html.

See attached file: 0410motorcycle_market_trends.pdf